north dakota sales tax exemption

Several examples of exemptions to the state sales tax are prescription. We provide sales tax rate databases for businesses who manage their own sales.

Printable North Dakota Sales Tax Exemption Certificates

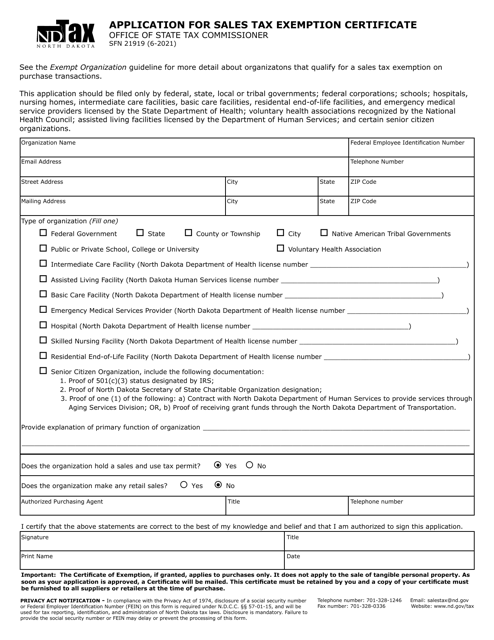

The Office of State Tax Commissioner is required by law to disclose the amount of any tax incentive or exemption claimed by a taxpayer upon.

. The exemption for each new mine is limited to the first 5 million of sales and use tax paidThe exemption extends to replacement machinery or equipment if the capitalized investment in the new mine exceeds 20 million. To obtain the sales tax exemption certificate eligible organizations must contact the Office of State Tax Commissioner. Step 2 Enter the purchasers State of origin and State and Use Tax Permit number.

This is a sales and use tax exemption and refund for machinery or equipment used to produce coal from a new mine in North Dakota. North Dakota has sales and use tax exemptions for specific products and services qualifying organizations and exemptions based on specific conditions and incentives. You can use this form to claim tax-exempt status when purchasing items.

Use exemption code 14 on the Application for Certificate of Title Registration of a Vehicle SFN 2872 North Dakota Department of Veterans Affairs - 4201 38th St S Suite 104 Fargo ND. Raised from 7 to 8. North Dakota sales tax is comprised of 2 parts.

For other North Dakota sales tax exemption certificates go here. Exact tax amount may vary for different items. Property Tax Credits for North Dakota Homeowners and Renters.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. This page describes the taxability of. North Dakota tax exemption info.

New State Sales Tax Registration. Ad Exempt Sales State Tax information registration support. Raised from 7 to 75.

Governor Jack Dalrymple R of North Dakota has signed legislation that creates a sales and use tax exemption for materials used to construct a fertilizer or chemical processing. Ohio Sales Tax Table at 65 - Prices from 631900 to 636580. While North Dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

In addition agricultural commodity processors. Simplify North Dakota sales tax compliance. To obtain exemption provide to vendors a copy of the Universitys exemption certificate.

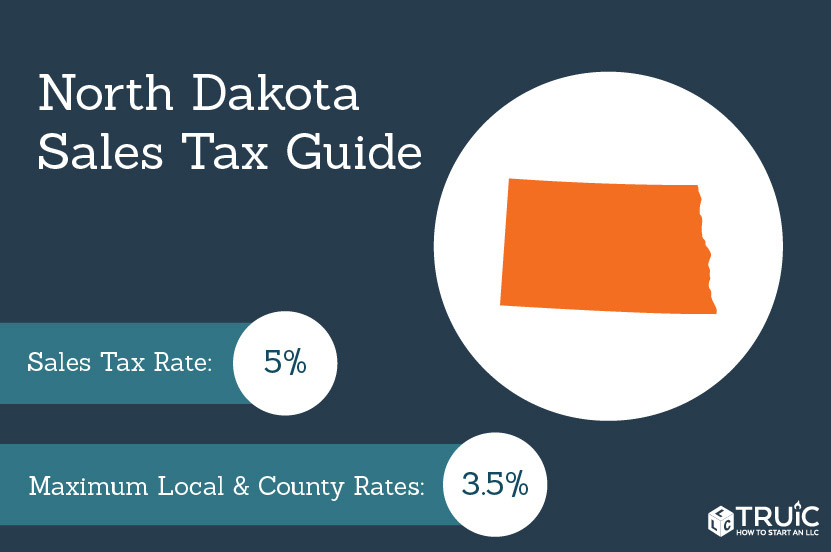

The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 0959 for a total of. There are a few important things to note for both.

North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders. Homestead Credit for Special Assessments. Registered users will be able to file and remit.

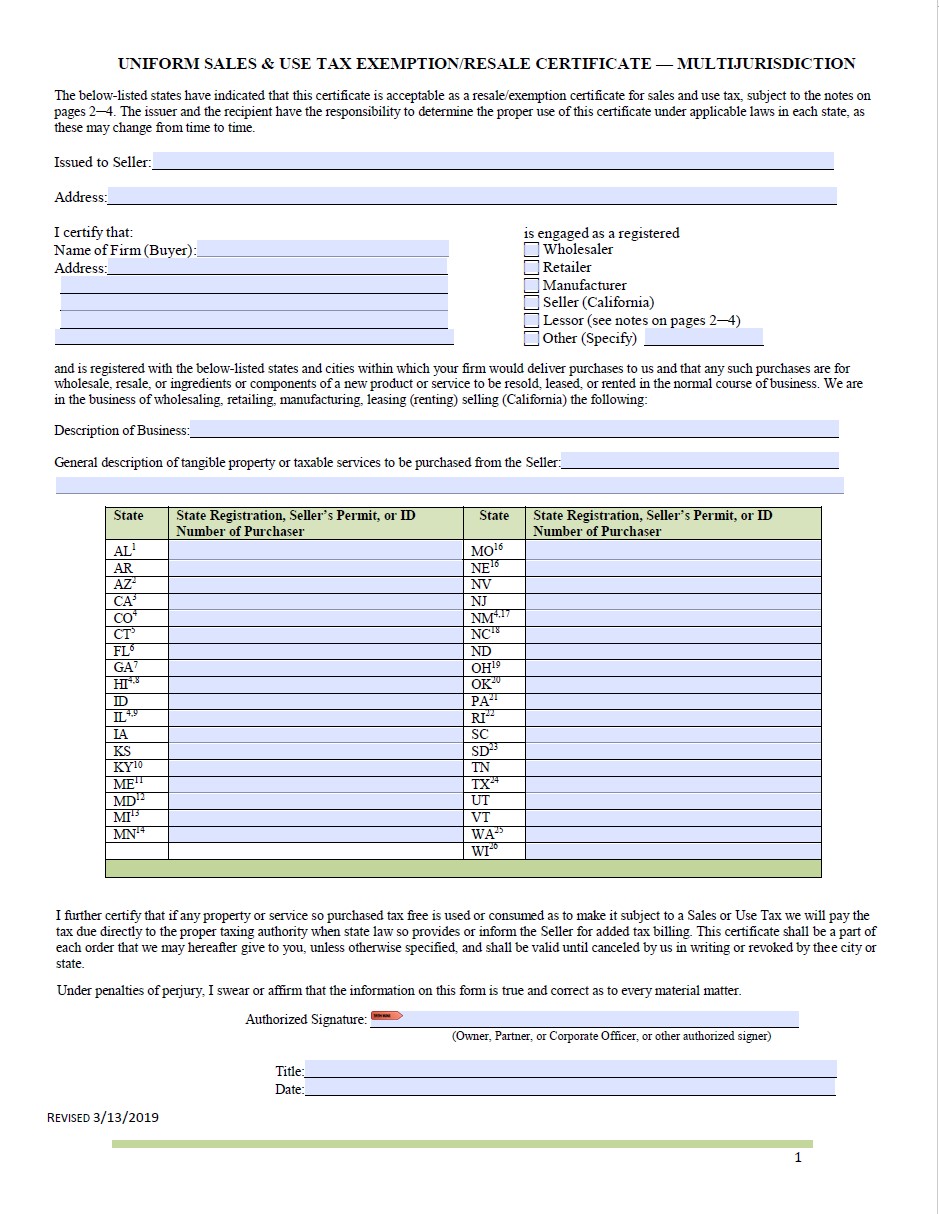

Simplify Ohio sales tax compliance. The state of North Dakota levies a 5 state sales tax on the retail sale lease or rental of most goods and some services. Step 1 Begin by downloading the North Dakota Certificate of Resale Form SFN 21950.

North Dakota Office of State Tax. Need to complete a Sales. In North Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Property Tax Credit for Disabled Veterans. Office of State Tax Commissioner. Local jurisdictions impose additional sales taxes up to 3.

While North Dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. This page describes the taxability of. We provide sales tax rate databases.

The letter should include. For purchases made by a North Dakota exempt entity the purchasers tax. A North Dakota resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to.

The sales tax is paid by the purchaser and collected by the seller. To apply for a sales tax exemption the taxpayer must submit a letter of application to the Office of State Tax Commissioner by email or mail. State Sales Tax The North Dakota sales tax rate is 5 for most retail.

Tax permit number issued to you or your business by the North Dakota Office of State Tax Commissioner. The North Dakota sales tax law provides for a sales tax exemption on machinery and equipment purchased by new or expanding manufacturers. 2022 North Dakota state sales tax.

How to use sales tax exemption certificates in North Dakota.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

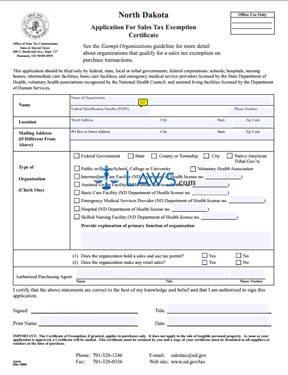

Form Sfn21919 Download Fillable Pdf Or Fill Online Application For Sales Tax Exemption Certificate North Dakota Templateroller

North Dakota Sales Tax Small Business Guide Truic

North Dakota Sales Tax Exemptions Agile Consulting Group

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch Social Security Benefits Social Security State Tax

Free Form 21919 Application For Sales Tax Exemption Certificate Free Legal Forms Laws Com

Minnesota Bill Of Sale Form For Ibm Storage Equipment Download The Free Printable Basic Bill Of Sale Blank Form Bill Of Sale Template Minnesota Hennepin County

.png)

States Sales Taxes On Software Tax Foundation

Arizona Student Loan Forgiveness Programs Arizona State Of Arizona Arizona State

No 1 Ocean City N J Ocean City Seaside Towns Ocean City Nj

Colorado Sales Tax Sales Tax Tax When You Know

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax Brackets

Visualizing Unequal State Tax Burdens Across America Visualizing Unequal State Tax Burdens Across America What Percentage Of State Tax Finance Function Tax

Financial Trusts And Secrecy In The U S Tax Haven Of South Dakota Watch An Excerpt From Frontline And Icij S New Pandora Pa Tax Haven South Dakota Frontline